Czech Republic sees moderate growth in company numbers despite rising liquidations

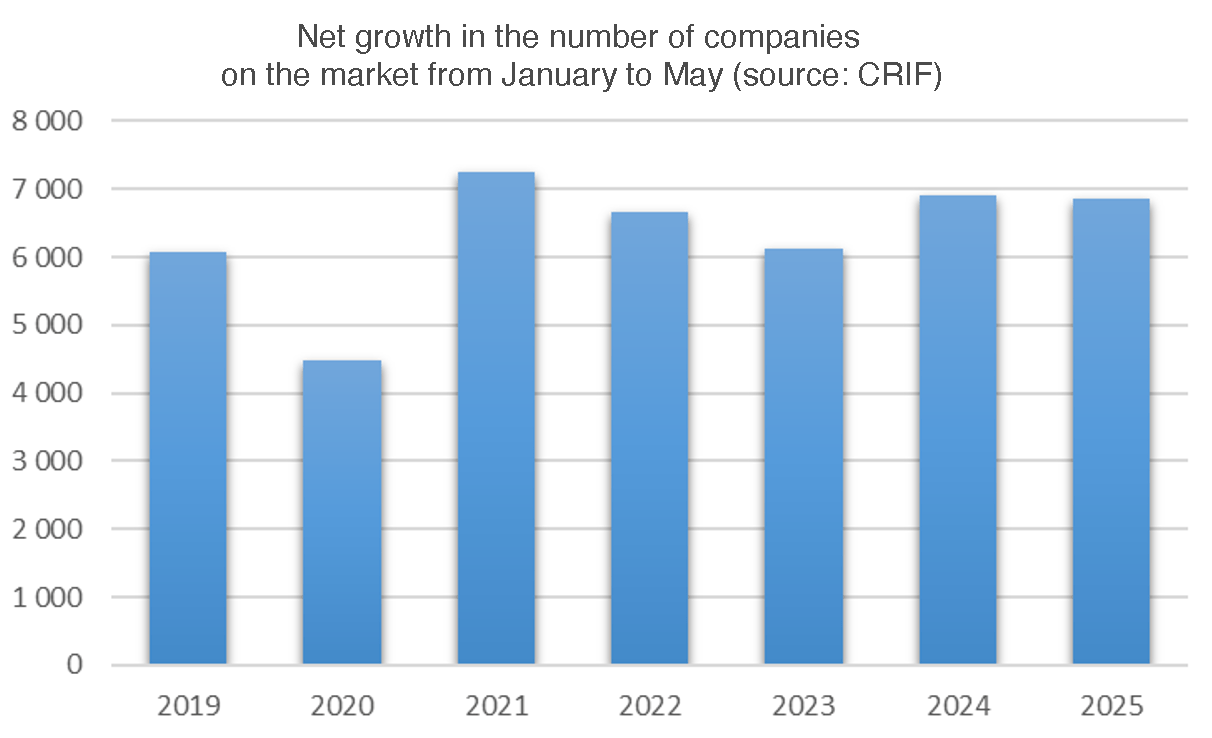

In May 2025, 2,645 new companies were established in the Czech Republic while 1,356 ceased operations, resulting in a net increase of 1,289 companies. According to CRIF – Czech Credit Bureau, this brings the total increase in the number of companies for the first five months of the year to 6,857, representing a 1% decline compared to the same period in 2024.

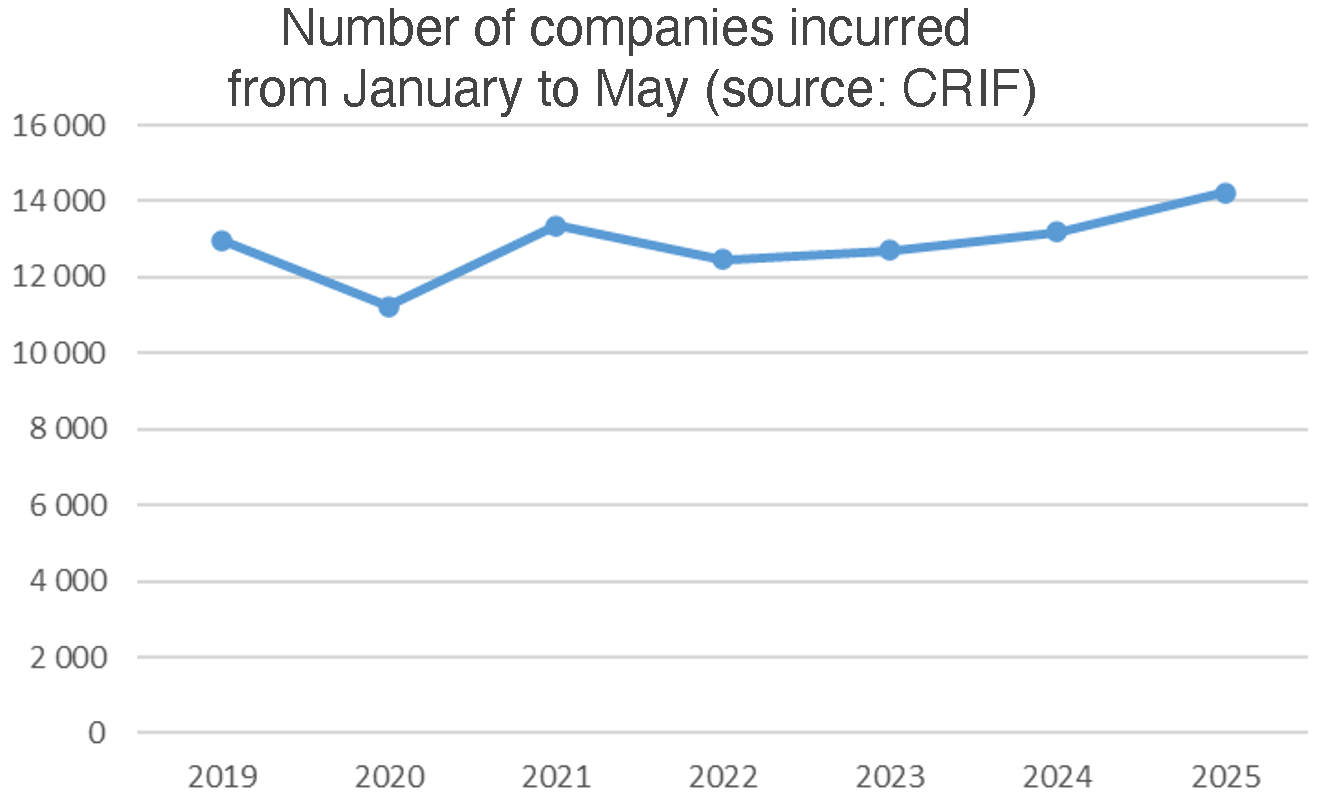

The data, based on figures from the portal www.informaceofirmach.cz, show that over the 12-month period ending in May, 31,950 companies were newly established, up 8% from the previous year. During the same period, 18,181 companies were closed, marking a 15% increase. The pace of company liquidations in the first five months of this year rose by 17% compared to last year. However, the number of companies entering the market grew at a similar rate to 2024, with 13,769 new market entrants over the past 12 months.

Regional developments indicate that the number of companies increased in 12 out of 14 regions. Prague accounted for more than half of all newly established companies during the 12-month period, followed by the South Moravian and Moravian-Silesian regions. The Olomouc and Vysočina regions recorded the fastest growth relative to company closures, with six new companies established for every ten that ceased operations. In the South Bohemian Region, the ratio was 25 new companies for every ten closures.

In contrast, the Liberec and Ústí regions recorded net declines. In Liberec, the number of companies dropped by 94, and in Ústí by 150. The Liberec region also recorded the sharpest increase in liquidations, where the number of companies that ceased to exist nearly tripled in the first five months. The Pardubice region saw a similar trend, with a 177% year-on-year increase in company closures.

From January to May 2025, the highest number of company registrations occurred in Prague, followed by the South Moravian and Central Bohemian regions. The Olomouc region saw the largest year-on-year growth in new company registrations at 13%, while the Zlín region experienced the most significant decline, down by 21%.

Sectoral analysis shows that the highest number of new companies were created in the business services sector, followed by real estate management and construction. These sectors also experienced the highest number of company closures. Business services saw 5,410 closures, while real estate and professional services followed with 3,519 and 2,577 respectively.

Despite higher numbers of closures in some sectors, others recorded rapid expansion. The highest relative growth was observed in services such as repair of personal items, hairdressing, and dry cleaning, with 62 new companies for every ten closures. The healthcare and social care sectors also expanded, with 50 new companies for every ten closures, closely followed by education with 49.

The structure of company longevity is also shifting. In the first five months of 2025, 14% of companies that ceased operations had been in business for 31 to 35 years, up from 10% the previous year and 4% in 2022. Meanwhile, the proportion of companies that closed within five years of operation dropped to 6%, down from 8% in recent years and 10% in 2022.

The findings highlight both resilience and volatility in the Czech business landscape, with overall company growth continuing amid a notable rise in closures and evolving patterns of business longevity.