European Investment Outlook 2025: Selective optimism amid structural shifts

As Europe steps into 2025, investors are cautiously optimistic. After years of muted economic performance, the eurozone is expected to post GDP growth of around 1.3%, signaling a mild recovery — though still lagging the US and Asia. Industrial production and retail sales are showing green shoots, but weak consumer sentiment and geopolitical uncertainties continue to weigh on the broader outlook.

Capital Markets Reawakening

Investment volumes across European real estate are set to rebound in 2025 after multiple years of decline. Notably, capital is gravitating toward resilient sectors such as logistics, multifamily residential, and life sciences, where structural demand drivers remain intact. Prime office assets in top locations with strong ESG credentials are attracting investor appetite, while secondary stock increasingly faces discounts or repositioning requirements.

Fundraising for European real estate funds remains active, particularly in income-producing and value-add strategies. Cross-border capital flows from North America and Asia continue to play a key role, underpinned by the relative stability and transparency of European markets.

Sustainability as a Market Imperative

A defining theme is the rising importance of ESG compliance. Energy efficiency, green certifications, and sustainability credentials are no longer optional — they are now core to pricing and liquidity. Investors are sharply focused on assets that meet evolving EU environmental standards, while non-compliant properties risk becoming stranded or requiring heavy capital expenditure to remain competitive.

Financing and Debt Landscape

The European financing environment is stabilizing, but debt costs remain elevated relative to pre-2022 levels. While interest rate cuts are anticipated in late 2025, the timing and scale remain uncertain. Investors are approaching underwriting with caution but are increasingly comfortable backing deals with resilient income profiles and defensible tenant bases.

Key Risks to Watch

• Geopolitical volatility (Ukraine conflict, Middle East tensions, global trade disputes)

• Interest rate uncertainty, affecting borrowing and capital costs

• Occupier risk in offices, where the divide between ESG-compliant and legacy assets is widening

• Regulatory shifts, including foreign investment rules and new tax or ESG reporting requirements

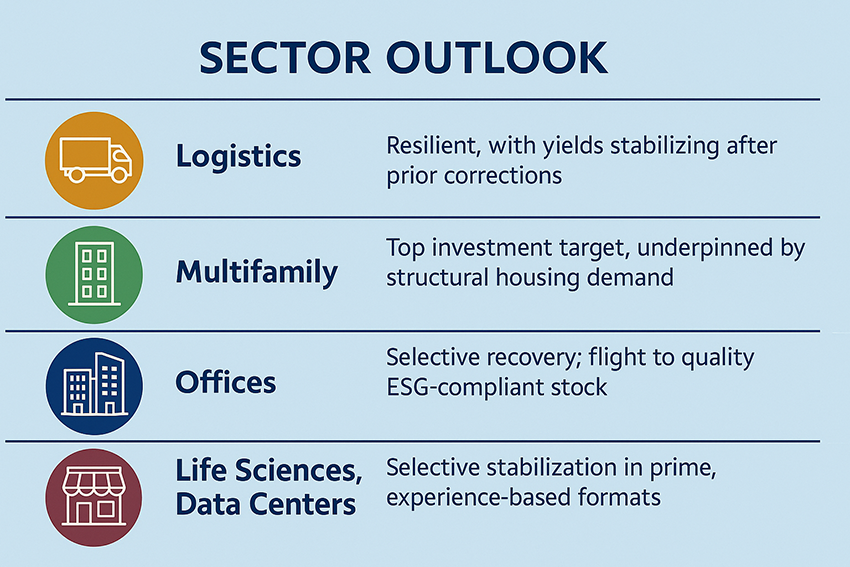

Sector & Outlook

Logistics - Resilient, with yields stabilizing after prior corrections

Multifamily - Top investment target, underpinned by structural housing demand

Offices - Selective recovery; flight to quality ESG-compliant stock

Retail - Selective stabilization in prime, experience-based formats

Life Sciences, Data Centers - Strong demand, though limited investable supply

Summary

Europe’s real estate landscape in 2025 offers selective opportunities, particularly for investors aligned with structural growth themes and ESG imperatives. While macroeconomic and geopolitical headwinds persist, disciplined capital with a focus on prime assets and resilient sectors is well-positioned to capitalize on the continent’s gradual recovery.

Source: Savilles and comp.