GARBE PYRAMID-MAP: European logistics real estate market stabilizes after price correction

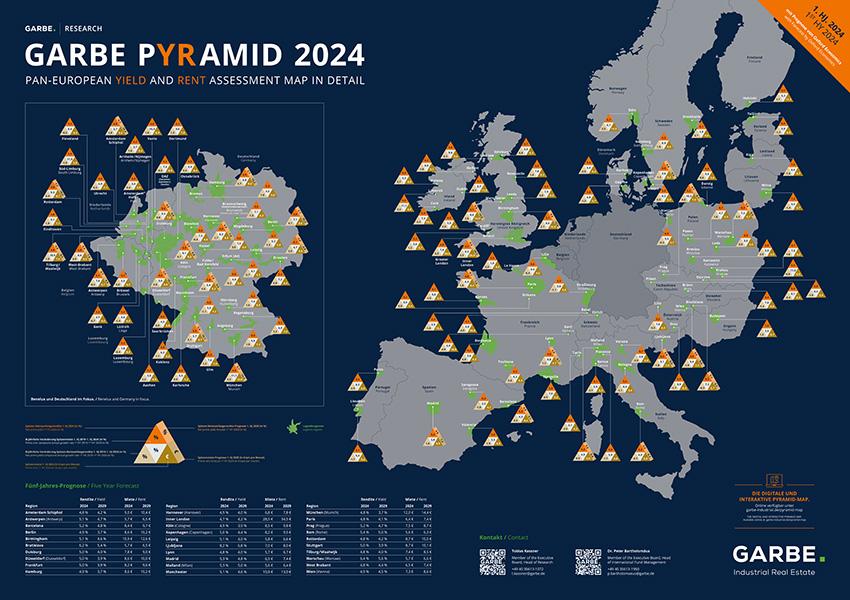

The European logistics real estate market has largely concluded its price correction, with investment stability returning in the first half of 2024, according to the latest GARBE PYRAMID MAP report. Despite economic and geopolitical challenges, the logistics sector remains resilient, with prime net initial yields transitioning into a stable sideways trend after a period of decompression in many European countries. Demand for logistics space has slowed due to weaker business conditions, though the decline is easing, and rental growth is cooling off as a result.

In the first half of 2024, logistics claimed a 21% share of the overall European investment market, trailing slightly behind office spaces (24%) and residential (23%). Tobias Kassner, Head of Research and Management Board member at GARBE, highlighted that despite complex market conditions, logistics remains one of the most attractive real estate asset classes, thanks to its strong return/risk ratio.

Prime Rents Increase by 1.4% in First Half of 2024

Although demand for space has weakened, prime rents continued to rise, albeit at a slower pace. Across the 116 surveyed logistics regions, prime rents grew by 1.4% during the first half of the year. Robust markets, particularly in the Netherlands and Germany, saw the strongest growth, with regions like Venlo (+7.8%), South Limburg (+7.4%), Munich (+7.1%), Eindhoven (+6.0%), and Mannheim (+5.9%) leading the way. Dr. Peter Bartholomäus, Head of Fund Management & Capital Markets at GARBE, noted that companies in these areas are willing to accept higher prices due to the scarcity of attractive logistics units.

Five-Year Forecast Predicts Continued Growth

For the first time, the GARBE PYRAMID MAP includes a five-year forecast, developed in collaboration with Oxford Economics. The forecast predicts an average annual growth of 3.1% in prime rents across 30 selected European logistics markets, surpassing the projected inflation rate within the eurozone. The forecast anticipates strong growth in cities like London and Munich, where prime rents are expected to rise by 3.9% and 3.8% annually, respectively. Berlin, Hamburg, and Manchester follow with 3.5% growth each.

Kassner attributes this optimistic outlook to several key factors: the resumption of e-commerce expansion, particularly in food and fashion; the nearshoring trend that is reshaping supply chains, especially in southern and eastern Europe; and advancements in new technologies such as battery cell production, electric vehicles, and semiconductors. These factors are expected to drive further demand and create new opportunities within the European logistics real estate market.

For more figures and methodological details, see the interactive GARBE PYRAMID MAP on the link below:

https://nl.rueckerconsult.de/img/240829_Garbe_Infografik_Logistik_24_2_Europe_Screen_25919992024.pdf