Markets recover after a historic tariff-led volatility: GCC stays resilient amid global swings

April 2025 marked one of the most volatile months in global equity markets, driven by escalating tariff tensions and disruption to global trade. Investor sentiment was severely shaken as negotiations between the world’s two largest economies failed, pushing consumer confidence to its lowest point in a decade. This standoff resulted in sharp downward revisions to GDP forecasts globally and significantly lifted inflation expectations, particularly in the U.S. Investors began betting heavily on rate cuts, but the U.S. Federal Reserve clarified that future cuts would depend largely on inflation trends.

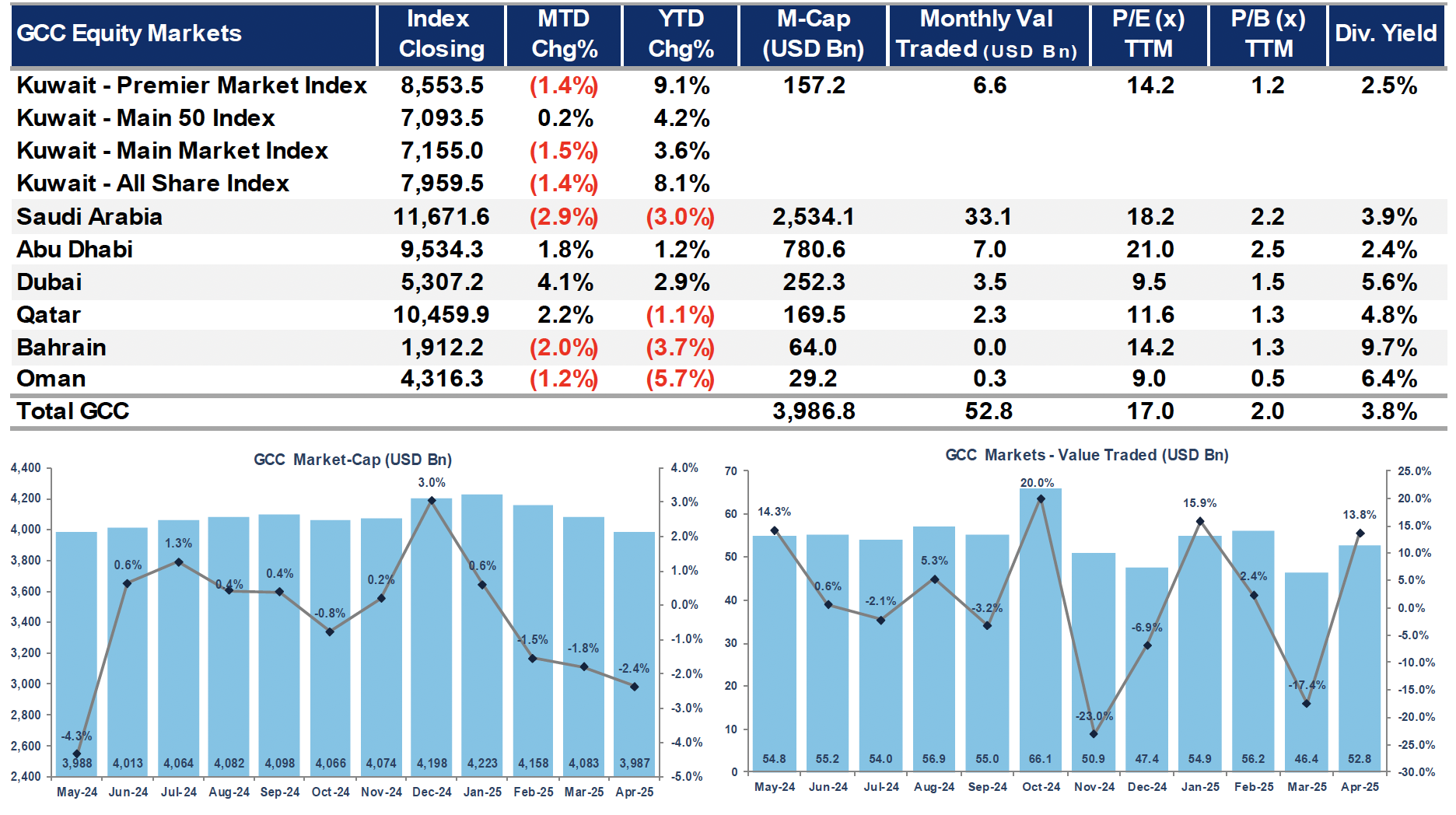

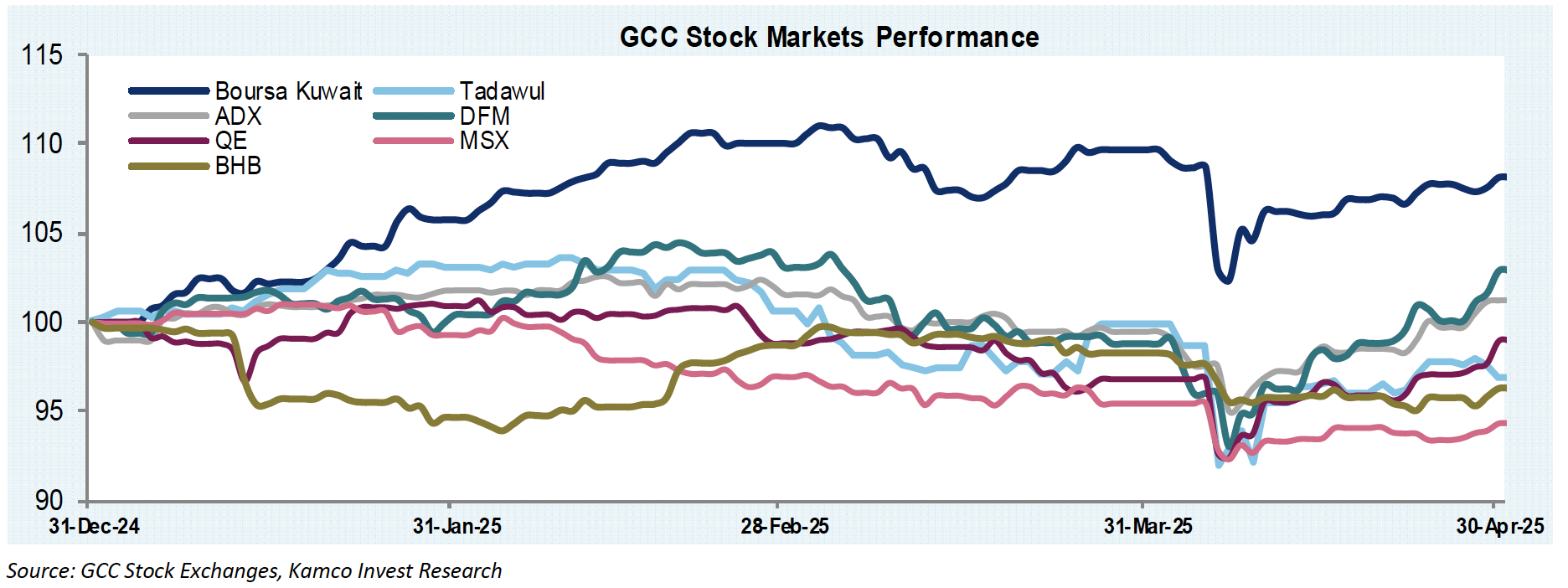

Other asset classes mirrored the turbulence. Oil prices dropped due to fears of shrinking global demand paired with an increase in OPEC+ supplies. However, the impact of these global jitters was less dramatic in the Gulf Cooperation Council (GCC) markets. The MSCI GCC Index posted only a modest decline of 1.2% in April, underscoring the region’s relative insulation from the direct effects of global tariffs. Yet even within the GCC, performance varied sharply across countries and sectors.

Saudi Arabia’s Tadawul All Share Index (TASI) saw the steepest drop among GCC peers, falling 2.9% during the month. This marked its third consecutive monthly decline, weighed down by weaker crude oil prices, regional geopolitical concerns, and disappointing corporate earnings. Notably, the Transportation sector was the hardest hit, with a 7.4% slide, followed by Utilities (-6.7%) and Financial Services (-5.9%). However, some bright spots emerged: the Pharmaceuticals and Biotech sector rose by 4.7%, and Telecommunications gained 4.3%.

Foreign investors were net buyers on the Saudi exchange in April, even as local institutions sold off in line with broader emerging market outflows. Trading activity in Saudi Arabia surged, with monthly share volumes up 17.5% to 6.7 billion shares and the total value of shares traded jumping 39.4% to SAR 124.2 billion.

Kuwait’s market also reflected mixed dynamics. While the overall All Share Index dropped 1.4%, the Main 50 Index managed a slim 0.2% gain thanks to strength in smaller, liquid stocks. Year-to-date (YTD), however, Kuwait remained one of the top performers globally, with the Premier Market Index up 9.1% and the All Share Index up 8.1%. Sectorally, Consumer Staples led gains with a 6.3% surge, driven by Mezzan Holding Co.’s strong rally, while the Insurance sector suffered a steep 15.1% decline.

Dubai stood out as the best-performing GCC market in April, rebounding 4.1% to erase part of March’s losses and lifting its YTD gain to 2.9%. This recovery was fueled mainly by heavyweight sectors like Financials (+5.9%) and Communications (+7.9%). Commercial Bank of Dubai surged 22.8%, and National General Insurance rose 16.4%, pushing the index higher. In contrast, the Materials sector dragged down overall performance, tumbling 22.7%, mainly due to the sharp decline in National Cement’s share price.

Abu Dhabi’s FTSE ADX General Index rose 1.8% in April, reversing declines seen in February and March. The Basic Materials sector led gains, up 6.1%, with Fertiglobe and Borouge shares delivering strong performances. Financials followed, rising 3.0%, supported by Abu Dhabi Islamic Bank (+14.1%) and Multiply Group (+28.9%). However, Utilities fell sharply by 9.7%, weighed down solely by Abu Dhabi National Energy Co.

Qatar’s market rebounded with the QE 20 Index gaining 2.2%, and the broader All Share Index up 2.5% in April. Telecoms was the star performer with a 12.2% jump, as both Ooredoo and Vodafone Qatar posted healthy gains. Banks also delivered solid results, with Doha Bank jumping 22.7% and Ahli Bank climbing 8.2%. Meanwhile, the Industrials and Transportation sectors slipped slightly, down 0.7% and 0.8%, respectively.

Bahrain’s All Share Index fell for the second consecutive month, dropping 2.0% in April and cutting its YTD gain to 3.7%. The Materials sector posted the largest decline at 11.6%, driven by Aluminium Bahrain’s share price drop. On the upside, the Consumer Discretionary sector rose 7.0%, with Gulf Hotels Group advancing 12.2%.

Oman’s MSX 30 Index saw its fifth consecutive monthly decline, slipping 1.2% in April. While the Industrial Index posted a 2.4% gain, led by National Aluminium Products Co.’s extraordinary 155% rally, it was not enough to offset broader losses, particularly in the Services sector, which fell 3.8%.

Looking beyond equities, GCC trading activity was robust in April, even amid global turmoil. Total monthly trading volume surged by nearly 28% across Kuwait, while Saudi Arabia and Abu Dhabi recorded volume increases of 17.5% and 33.3%, respectively. Notably, Oman bucked the trend, with only a marginal 1.4% volume gain, and saw a decline in the total value traded by 15.2%.

In terms of economic developments, Abu Dhabi’s real estate market showed strong momentum, with property transactions up 34.5% year-on-year in Q1 2025, totaling AED 25.3 billion. Foreign direct investment into Abu Dhabi real estate also rose, with 384 transactions worth AED 1.58 billion completed by investors from 68 countries.

Dubai’s tourism sector continued its steady recovery, welcoming 5.31 million visitors in Q1 2025, up 3.3% year-on-year. Western Europe remained the top source of visitors, followed by the CIS/Eastern Europe and the GCC region, boosting sectors like hospitality and retail.

However, Bahrain faced headwinds, with S&P downgrading its outlook from “Stable” to “Negative,” citing rising fiscal deficits and pressure from lower oil prices and increased social spending. The IMF also cut Bahrain’s 2025 GDP growth forecast by 40 basis points to 2.8%.

Oman, meanwhile, projected 2025 GDP growth at 3.4%, supported by strong foreign direct investment, though the IMF revised its estimate downward to 2.3%, citing global trade tensions and weaker oil price prospects.

Overall, despite April’s historic global volatility, the GCC markets showed resilience, selectively outperforming or cushioning the global downturn. Sector-specific gains in telecoms, financials, and real estate helped offset broader market weakness, while economic indicators across the region pointed to continued structural reforms and growth initiatives that could position the region well in the months ahead.