Production price trends in Slovakia – May 2025

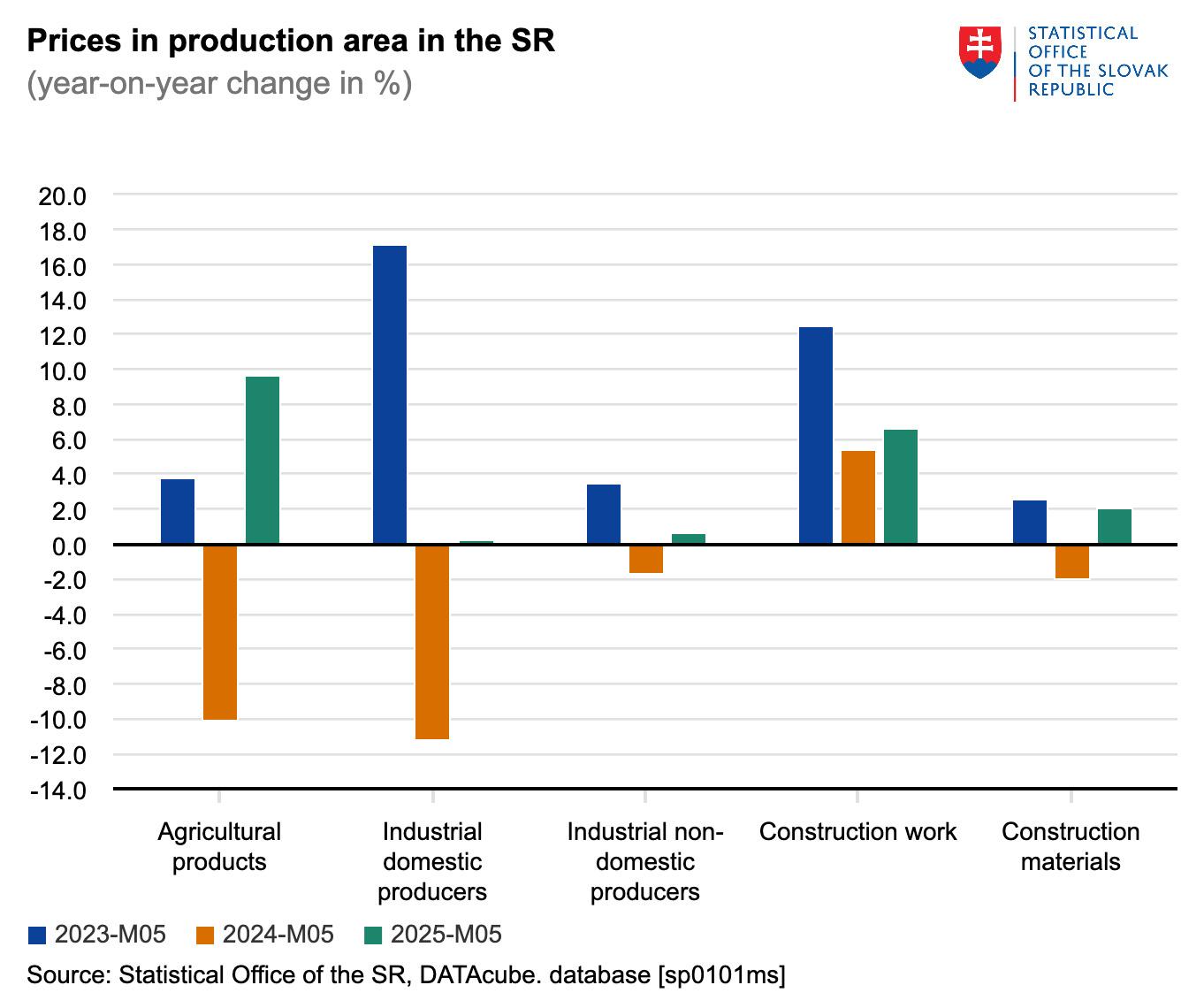

According to the Statistical Office of the Slovak Republic, producer prices across key sectors showed varied movements in May 2025. Agricultural product prices recorded a notable year-on-year increase of 9.6%, while industrial producer prices remained mostly stable compared to the previous year. Construction prices, however, saw their fastest year-on-year growth since late 2023.

In agriculture, both crop and animal products experienced price increases. Crop product prices rose by 10.6%, with cereals, oilseeds, and fruits showing double-digit gains—fruits and nuts increased by 16.7%, legumes by 13.7%, and potatoes saw their first rise this year at 0.7%. Vegetable prices continued to decline year-on-year, though the drop narrowed to 4.8%.

Animal product prices were also up, with cow’s raw milk rising by 13.4%, slaughter sheep and lambs by 14.2%, and hen eggs showing the highest increase at 41.4%. In contrast, prices declined for slaughter pigs (–4.5%), poultry for slaughter (–1.6%), and raw sheep wool (–45.5%). Overall, agricultural producer prices rose by 8% during the first five months of 2025.

In the industrial sector, producer prices for the domestic market in May were up 0.2% year-on-year and down 0.6% month-on-month. From January to May, prices increased by 0.8%. Sectors such as rubber and plastic products (+3.7%), food and beverages (+3.1%), and water supply (+3.7%) saw growth. However, prices in coke and petroleum product manufacturing declined significantly (–19.5%), along with a 1% drop in energy and gas prices.

Construction saw a year-on-year producer price increase of 6.6% in May—the steepest since December 2023. Over the first five months of the year, construction prices rose by 5.7%. Prices for construction materials increased by 2% year-on-year and by 2.1% cumulatively since January.

These trends reflect a moderate overall rise in producer prices, with strong growth in agriculture and construction, while industrial prices remained largely stable amid continued pressure from lower energy and commodity prices.